are assisted living expenses tax deductible in 2019

Residents who are not chronically ill may still deduct the portion of their expenses that are attributable. The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction.

Assisted Living Resident Transportation Mobilityworks

100 Free Federal for Old Tax Returns.

. Calculate your net federal tax by completing Step 5 of your tax return to find out what is more beneficial for you. If their long-term care expenses are more than 10 of your gross income as of 2019 and they are considered chronically ill these expenses are tax deductible. In any case the expenses are not deductible if they are reimbursed by insurance or any other programs.

This deduction can be taken on your federal income taxes. You can deduct assisted living expenses if you or your spouse is a qualified individual. For elders who live in assisted living communities part or all their assisted living expenses might qualify for a tax deduction.

If you or a loved one is living in an assisted living facility there may be some expenses that qualify as tax deductible. Everything is included Prior Year filing IRS e-file and more. And I think that will suffice as her care plan I know all of her.

Income Tax Deduction for Assisted Living Costs. If that individual is in a home primarily for non-medical reasons then only the cost of. The Conditions That Determine if Assisted Living Can Become Tax Deductible.

If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. For information on claiming attendant care and the disability amount see the chart. Physical factors of chronic illness include the inability to feed themselves dress bathe or get to the bathroom.

Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill. Yes in certain instances nursing home expenses are deductible medical expenses. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes.

According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care services on your taxeswith some qualifications and restrictions of course. Qualifying medical expenses that make up more than 75 of the residents adjusted gross income can be deducted.

Mental factors include requiring supervision for their protection against dementia. Which means a doctor or nurse with diagnosing abilities has stated that the patient cant perform at least two daily. There are special rules when claiming the disability amount and attendant care as medical expenses.

Assisted living facilities primarily help residents with non-medical needs. Oct 29 2019 If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

Ad Prepare your 2019 state tax 1799. Yes assisted living expenses are tax-deductible. Lets take a closer.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Understand The Major Changes. Chronic Illness and Tax Deductible Status.

4 Ways Your Tax Filing Will Be Different Next Year. Certain conditions that must be met to qualify. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense.

Ad Check For The Latest Updates And Resources Throughout The Tax Season. And yes even the medical expenses that do not directly affect your health may become deductible depending on certain conditions. Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some of the expenses or fees can potentially be deducted to make this a more affordable option.

Special rules when claiming the disability amount. You can also see the examples. As the April 15 tax deadline fast approaches.

In general for taxable years beginning on or after January 1 2019 California conforms to the following TCJA provisions. This could be annual expenses. Different medical expenses can be tax deductible.

The IRS has laid out the guidelines pertaining to tax deductible medical expenses.

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Tax Tips For The Self Employed Massage Therapist Discoverypoint School Of Massage Seattle Wa

3 14 1 Imf Notice Review Internal Revenue Service

A Creative Way To Pay The Long Term Care Bill Thestreet

You May Be Able To Deduct Some Ccrc Costs From Your Taxes Mylifesite

Two Assisted Living Closures In Tillamook County Mark Oregon S First In 2022 The Lund Report

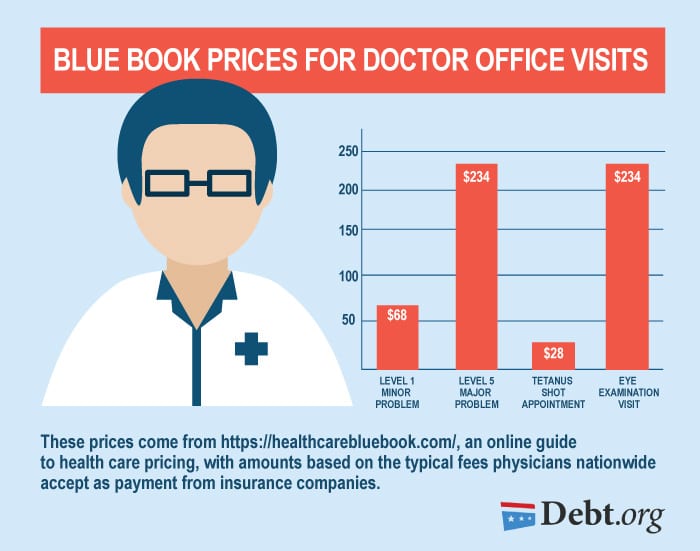

How Much A Doctor Visit Will Costs You Blue Book Prices

You May Be Able To Deduct Some Ccrc Costs From Your Taxes Mylifesite

3 14 1 Imf Notice Review Internal Revenue Service

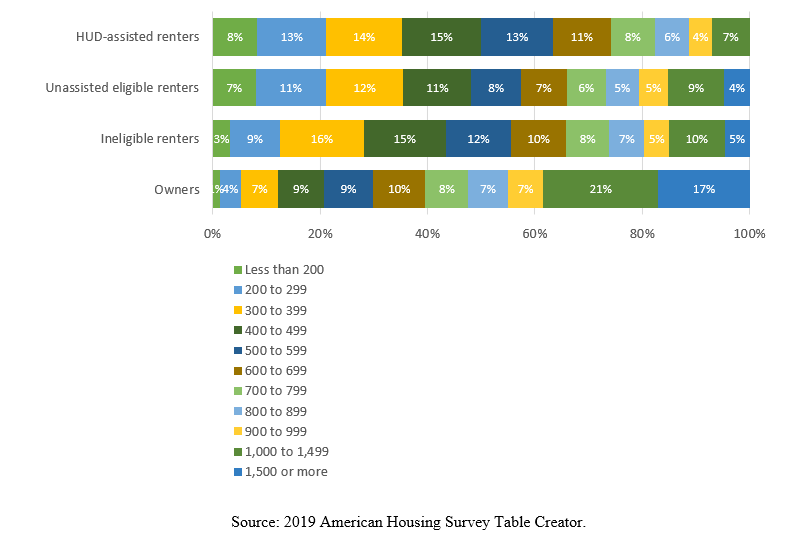

Covid 19 Risk Factors Among Hud Assisted Renters Hud User

I Have Entered Expenses That Are Not Showing On The Reconciliation Report The Dates Are Correct And The Charges Are There But They Will Not Populate The Reconcilation Re

What Is Adjusted Gross Income H R Block

The 10 Best Assisted Living Facilities In Cedar Grove Nj For 2022

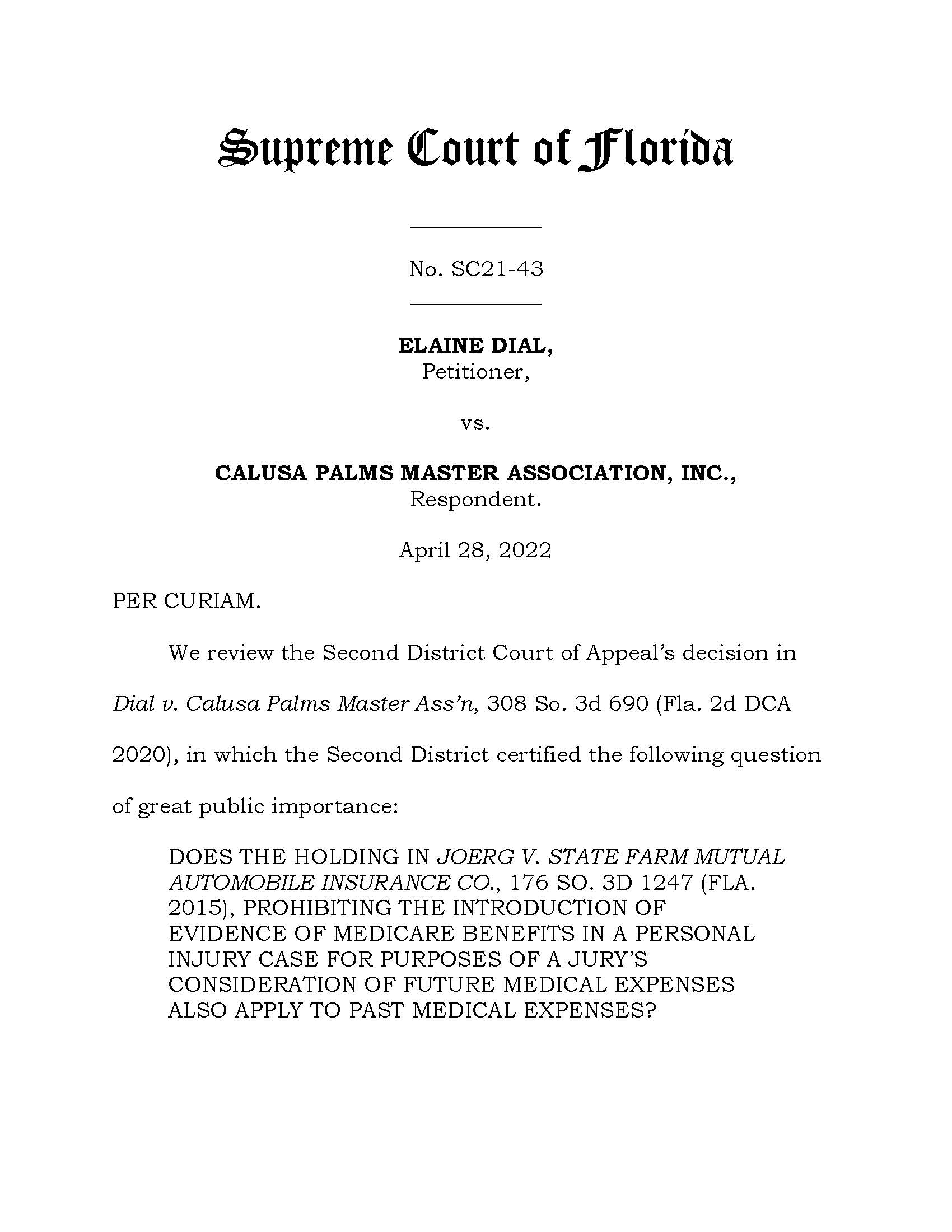

Florida Supreme Court Limited Admissibility Of A Plaintiff S Past Medical Expenses To The Discounted Amounts Paid By Medicare Kubicki Draper Florida Defense Litigation Lawyers

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

The 10 Best Assisted Living Facilities In Cedar Grove Nj For 2022

Two Assisted Living Closures In Tillamook County Mark Oregon S First In 2022 The Lund Report